Millionaire Tax Ballot Resolution

Whereas, in 2010 Governor Christie vetoed legislation to extend the higher tax rate on millionaires, thus providing them hundreds of millions of dollars in tax breaks that should have provided the relief needed by schools and municipalities; and

Whereas, in 2010 Governor Christie vetoed legislation to extend the higher tax rate on millionaires, thus providing them hundreds of millions of dollars in tax breaks that should have provided the relief needed by schools and municipalities; and

Whereas, that year Christie cut state aid to schools and municipalities by $2.3 billion, forcing the raising of property taxes and laying off thousands of teachers, public safety personnel and other public servants; and

Whereas, the revenue loss caused by that income tax cut for the rich forced increases not only in property taxes, which fall most heavily on working families, but also in many fees and charges for public services paid by middle and low income families, and forced direct cuts the income of the working poor by reducing the earned income tax credit; and

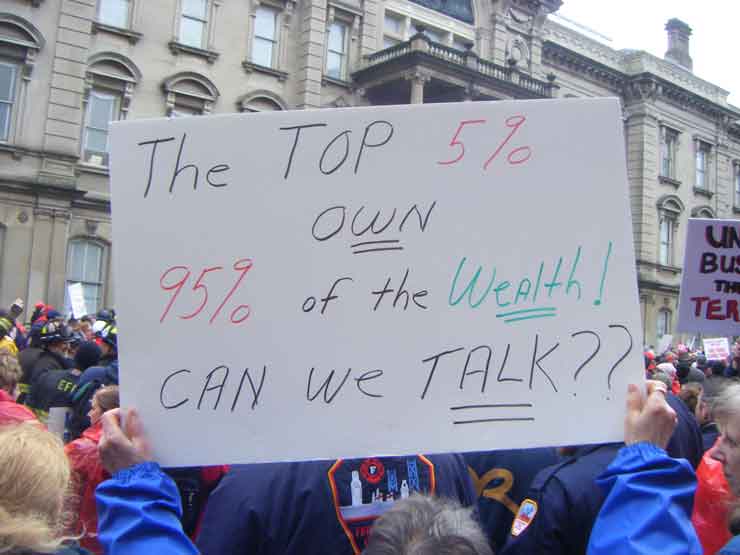

Whereas, such policies favoring the rich at the expense of working families harm the economy, because they exacerbate the trends of the last 30 years that lead to the current economic and fiscal crisis in the first place: cuts in the tax rates on the rich that reduced the top federal income tax rate to the lowest level in 80 years and the related extreme growth of income inequality reaching the worst levels in 80 years; and

Whereas, Democratic legislators have indicated that they will seek to restore $500 million in State funding for low income school districts as ordered by the State Supreme Court and also add $600 million in school aid for at-risk students in middle income district and finance that aid, in part, from $913 million raised by the restoration of the millionaire tax vetoed by the Governor last year; and

Whereas, while those measures would benefit children, create jobs and provide property tax relief, the Democrats do not have enough votes in either house to override another veto of the millionaire tax law; and

Whereas, the Democrats do have the 24 votes needed in the Senate and 46 of the 48 votes needed in the Assembly to pass a resolution to place the millionaire tax on the ballot in November of this year, which the Governor is not allowed to veto; and

Whereas, the overwhelming public support of the millionaire tax shown in opinion polls suggests not only that the ballot initiative would be passed by the voters, but that it would also improve the reelection prospects of those who vote to put the measure on the ballot.

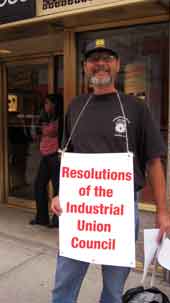

Therefore, be it resolved that the New Jersey Industrial Union Council supports and will lobby for a resolution of the Legislature to place the millionaire tax on the State-wide ballot this November, and will campaign for the ballot initiative and legislators who vote for it; and

Be it finally resolved that the New Jersey Industrial Union Council will communicate this resolution to its members and to the members of the NJ State Legislature forthwith.